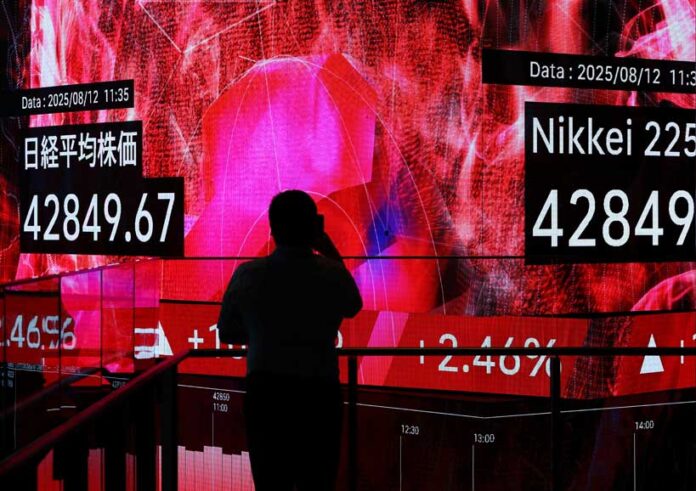

Global investors are redirecting funds to Asia, excluding China, with around $100 billion flowing into the region over the past nine months. The trend reflects a search for diversification as geopolitical uncertainty, tariffs, and supply chain risks reshape global finance. According to Goldman Sachs Asia-Pacific president Kevin Sneader, Japan has been one of the main beneficiaries, while China’s stock rally remains largely powered by domestic investors. At the same time, Singapore’s state investor Temasek has reported record portfolio growth, underscoring Asia’s rising role in global capital allocation.

Why It Matters

The shift signals a re-balancing of global finance. For decades, the U.S. has been the dominant destination for investment, but geopolitical frictions, including tariffs and political uncertainty, have made investors cautious. Asia, with its tech-driven growth and consumer markets, is increasingly seen as a hedge against U.S. volatility. However, much of the inflow is from hedge funds so-called “fast money” which can reverse course quickly, leaving markets exposed to sudden swings. The focus on technology, healthcare, and industrial highlights where investors see the region’s future strengths, but it also underscores the challenges of navigating a fragmented global order.

Goldman Sachs (Kevin Sneader): Stressed that flows reflect diversification, not abandonment of the U.S.

Temasek International (Dilhan Pillay): Warned that “globalisation as we knew it is gone,” with resilience now prioritized over efficiency in supply chains.

Foreign investors: Enthusiastic about Asia’s tech and industrial sectors, but cautious about China due to political risks.

Regional governments: Welcome inflows but remain wary of volatility tied to hedge fund-driven capital.

U.S. policymakers: Concerned that America’s relative dominance in global capital markets may erode if Asia continues to capture growing inflows.

Future Scenarios

If the trend continues, Asia could emerge as a primary global investment hub, with countries like Japan, Singapore, and India attracting sustained inflows that strengthen their financial markets. Alternatively, a sudden reversal of hedge fund flows could leave these economies vulnerable to instability, especially if global interest rates rise or geopolitical shocks occur. A more likely path may be steady but selective growth, with investors continuing to diversify portfolios in Asia while maintaining core positions in the U.S. The trajectory of U.S.-China relations will remain the key variable shaping whether Asia’s inflows accelerate or stall.

With information from Reuters.