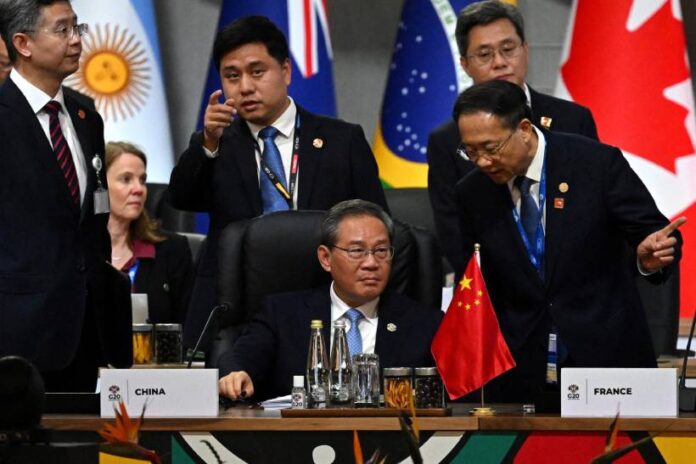

China and Germany have moved quickly to mend trade tensions that escalated after Beijing restricted exports of rare earths and chips, disruptions that have snarled German production lines and prompted calls to “de-risk” supply chains. Premier Li Qiang met German Chancellor Friedrich Merz on the sidelines of the G20 summit in South Africa, pitching closer collaboration in strategic industries including new energy, smart manufacturing, biomedicine, hydrogen technology, and intelligent driving. German Finance Minister Lars Klingbeil and top diplomat Johann Wadephul have also resumed high-level dialogue with their Chinese counterparts. China is Germany’s top European trade partner, with German auto, chemicals, and pharmaceutical firms heavily reliant on Chinese markets.

Why It Matters

Rare earths and other strategic components are critical to global high-tech and industrial production. China’s curbs on exports earlier this year revealed vulnerabilities in Germany’s manufacturing base, including autos and electronics, and underscored Europe’s reliance on Chinese supply chains. Restoring dialogue signals Beijing’s willingness to stabilize industrial flows while asserting its role as a global supplier. For Germany, balancing economic dependence on China with political pressure from allies like the U.S. highlights the ongoing challenge of managing strategic supply risks without alienating a key trading partner.

German industry particularly automakers, chemicals, pharmaceuticals, and advanced manufacturing stands to benefit directly from eased export controls. German policymakers, led by Chancellor Merz and Finance Minister Klingbeil, are focused on securing reliable access to rare earths and high-tech inputs while navigating geopolitical tensions. China’s government and state-backed firms aim to maintain Germany as a top European market and investor, leveraging bilateral ties to offset U.S. trade and technology pressure. The European Union observes closely, given implications for broader supply-chain strategies and collective European responses to China’s industrial policies.

What’s Next

Chancellor Merz is expected to visit China soon to meet President Xi Jinping, while diplomatic channels with Foreign Minister Wadephul are resuming. Both countries are likely to deepen engagement in strategic industries to reduce bottlenecks in rare earths, chips, and emerging tech sectors. Germany will continue to balance economic pragmatism with pressure from EU allies and the U.S. on issues like human rights, industrial subsidies, and supply-chain resilience. China may also push for policy alignment or reduced interference on geopolitical matters as a precondition for deeper cooperation.

With information from Reuters.