For decades, Japan’s government bond market has been anchored by the Bank of Japan’s ultra-loose monetary policy, characterized by negative interest rates and aggressive yield curve control. This framework made Japanese bonds a stable and attractive option for foreign investors, while also supplying cheap liquidity to global markets.

But the tide is turning. Persistent inflation, now running above the BOJ’s 2% target, and rising global interest rates are intensifying speculation that Japan’s central bank will soon move away from its accommodative stance.

The Latest Selloff

In the week through September 27, foreign investors sold a net 2 trillion yen ($13.60 billion) of long-term Japanese Government Bonds (JGBs), the largest weekly outflow in a year, according to Ministry of Finance data released Thursday. They also offloaded 3.22 trillion yen of short-term bills.

The sharp exit coincided with the yield on 10-year JGBs climbing to 1.665%, its highest level since 2008. Markets now see an increasing likelihood of a rate hike as early as the BOJ’s October 30 meeting, following signs of division among policymakers at the September 18–19 gathering.

Board member Asahi Noguchi, previously seen as dovish, said this week that the need for an interest rate hike was “more than ever,” reinforcing expectations of a shift.

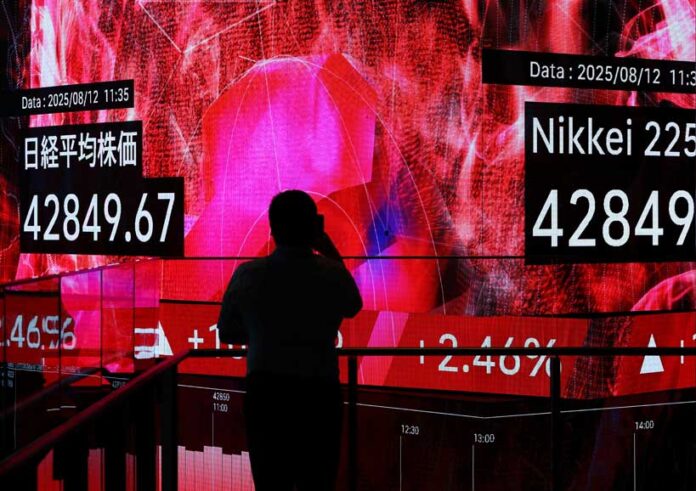

Pressure on Equities

Bond outflows were mirrored in the stock market. Foreigners sold 963.3 billion yen in Japanese equities last week, extending their selling streak to three weeks. Total foreign outflows for September amounted to 4.63 trillion yen, making it the third-largest monthly net selling in 11 years.

Domestic Investors Pull Back Abroad

Japanese investors also adjusted their portfolios. They pulled 162 billion yen from foreign long-term bonds, ending four weeks of net purchases, and sold 11.6 billion yen in overseas equities, marking a second week of withdrawals. The trend suggests investors are hedging against volatility abroad while awaiting clearer signals from the BOJ.

Why It Matters

Policy Turning Point: A BOJ rate hike would be its first step toward policy normalization after years of unprecedented easing.

Market Volatility: Rising yields threaten to disrupt Japan’s role as a stable anchor in global bond markets.

Capital Flows: Continued outflows highlight the sensitivity of foreign investors to BOJ policy signals, with broader implications for global liquidity.

Future Outlook

The coming weeks will be critical in determining whether the September selloff marks the start of a sustained shift or a temporary reaction to speculation. If the BOJ raises rates on October 30, foreign demand for JGBs could weaken further, potentially pushing yields higher and strengthening the yen. Such a move would also ripple through global markets, unwinding years of “carry trade” strategies that relied on cheap Japanese borrowing.

On the other hand, if the BOJ delays tightening, volatility may persist as markets question the bank’s credibility in managing inflation. Domestic investors are likely to continue recalibrating their overseas exposure, while foreign investors may stay cautious until policy direction becomes clearer.

Either way, Japan appears to be on the cusp of a monetary policy era that could reshape both its domestic economy and global capital flows.

($1 = 147.09 yen)

With information from Reuters.