The response of the USA to OPEC and its partner’s plan to reduce output by two million barrels per day was strong enough to suggest an uptick in hostilities with oil producers, particularly Saudi Arabia. Despite the fact that the decision was well anticipated, Washington saw it as a strong indication from its Gulf allies that they are not likely to comply with USA’s requests to continue oil production. In fact, it has started a war between the two major oil powers to make a serious impact on the energy regime. Hence the tug of war has an impact on the global energy domain since these two are the principal role player in the energy regime.

However, prior to the 2020 election, current US President Joe Biden urged to charge Saudi prince Mohammed bin Salman for the Jamal Khashoggi issue. The Trump era was quite friendly with the Saudi government. So, to confront Donald Trump Biden used the anti – Saudi stance in the 2020 election. Even the US government published a report on the issue after Biden was elected as the president. But the Ukraine war changed the landscape of global politics by introducing the energy crisis. To maintain a balanced price inside the USA, the Biden administration requested the KSA to put a bridle on the price. But despite having kept the USA’s urge the OPEC plus decided to hold the production of 2-million-barrel oil per day. It will help to move the price upward since the downward price of oil was alarming for the OPEC members. The rising oil price can determine the interim election in the USA. Hence the US responded strongly. But the KSA maintained its position. However, here the action of the two big powers in terms of energy will facilitate another round of energy crisis in the global market. The following portions will discuss the issue and what ramifications it will bring.

Strong Stance of the KSA

Suhail Al-Mazrouei, the energy minister for the Emiratis, stated to reporters following the Vienna summit that OPEC took action to assure that producers would continue to invest in new oil supply. “They have their own stories, too, in Europe,” he continued, “and in Russia. We cannot support either this nation or that nation. Moreover, Prince Abdulaziz bin Salman, Saudi Arabia’s energy minister, ruled out whatever political purpose and impliedly rejected the notion that the resolution entailed any hostility toward the US or other purchasers, claiming it was not done in defense of Russia. These portray that the KSA is not showing its intent in a hostile manner rather it wants to deal the tension through diplomatic channel.

NOPEC: Reappearing on the Set

The No Oil Producing or Exporting Cartels (NOPEC) bill will allow the U.S. attorney general to sue OPEC or its members, such as Saudi Arabia, in federal court. Other producers like Russia, which works with OPEC in wider group known as OPEC+ to withhold output, could also be sued.

The decision to reduce oil production, however, has already caused President Joe Biden to express his “disappointment,” adding that he would be exploring at “alternatives” to increase inventories. Hence, National Security Advisor Jake Sullivan and Director of the National Economic Council Brian Deese, two senior officials, issued a joint statement urging the White House to rethink its position and support the so-called NOPEC bill, which would hold the oil-producing cartel legally responsible for any price collusion.

Releasing Strategic Reserve: Not an Optimistic Option

The Biden administration’s alternative choice is to increase the amount of oil that is released from the strategic reserve, which is currently at its lowest levels since 1984. A previously stated release of tens of millions of barrels had no effect on the market, but further releases could lead to a supply surplus that would support further OPEC production cutbacks.

The Russia Factor

Washington commentators spouted accusations of Saudi Arabia “siding with Russia” after the OPEC+ announcement of relatively small production cuts. In a statement, the Saudi foreign minister revealed that the U.S. asked OPEC+ to delay announcing its production cut by a month and said that he rejects such “dictates” from Washington.

Moreover, according to OPEC, the decision is simply technical and for maintaining market stability. However, the US administration was enraged because Alexander Novak, the deputy prime minister of Russia and minister of energy, was present at the OPEC+ summit in Vienna. According to sources at OPEC, the US attempted to exert pressure on Austria to forbid his attendance, but OPEC+ members vowed to relocate the organization’s headquarters from there if its integrity was not upheld.

According to analysts, rising oil prices prior to a price cap would be advantageous for Russia, the largest non-OPEC producer. At least the discount starts at a higher price level if Russia is forced to sell oil below market value. Early in the year, high oil prices somewhat offset the sales Russia lost as Western consumers avoided its supplies. Additionally, the nation has been successful in redirecting almost two thirds of its traditional Western sales to buyers in nations like India.

However, as oil prices and sales volumes dropped, Moscow’s revenue from oil decreased from $21 billion in June to $19 billion in July to $17.7 billion in August, according to the International Energy Agency. The price limitations would further undermine a significant source of income since oil and gas revenues account for one-third of Russia’s federal budget.

Ramifications: “Weaponization of Oil”

The world will experience a surge in demand for oil. Besides, the global politics will divide into two separate blocs, though already the polarization is vivid enough. There are other ramifications of the war.

Firstly, The Biden administration plans to “re-evaluate” America’s eight-decade-old alliance with Saudi Arabia because of last week’s OPEC+ decision to cut oil production. But the White House posturing looks like a bid to distract from the effects at home of Washington’s failure to pursue a successful transition to clean energy.

Immediately following the OPEC+ decision, Roger Diwan, an analyst with S&P Global Commodity Insight, claimed in a note that the cuts represented a “weaponization of oil” and that the meeting’s timing and location were an intentional signal: The deputy prime minister of Russia, who is subject to US sanctions, was present to discuss limiting the oil supply as winter approaches and Russia has already militarized its gas deliveries to Europe. The confrontational course taken by Saudi Arabia will increase the price risk for oil.

Secondly, a shift in the gulf’s policy domain will be experienced. Some in the US perceived the decision as a failure of Biden’s Gulf policy because it was taken just over two months after Biden’s meeting with Saudi Crown Prince Mohamed bin Salman in Jeddah. The ruling Democratic Party was anxious about the Congressional midterm elections in addition to the conflict in Ukraine and the economic sanctions against Russia. With opinion surveys indicating that Republicans might win majorities in both the House and the Senate, high gas prices at the pump only worsen their already bleak prospects.

Thirdly, Saudi Arabia’s energy minister cautioned in a deliberate response to the American response that US-led plans for a price ceiling on Russian shipments are fanning the uncertainty that prompted OPEC+ to its largest output cut in two years. The perception that the next two months would be “a period of uncertainty” is increased by “the lack of details and the lack of clarity” regarding how the price ceiling will be put into place. People have no idea how the market or the participants would respond.

Fourthly, according to some Gulf sources, the “strategic alliance” between the US and Gulf nations will prevent the situation from turning into a full-blown energy crisis. They even assert that everything will “cool off” following the midterm elections later this month.

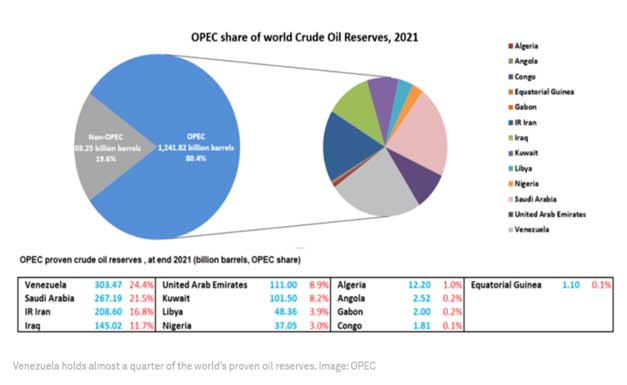

Sixthly, the USA will search for alternative sources in the African region for maintaining supply-chain of oil and gas. The visit of Biden to the African states was a sign of newer sources to ensure the security of commodities like oil.

Finally, the energy war is empowering the movement for renewable energies facilitated by the USA inside and outside the USA. The initial election mandate for the US president was to enable more renewable energy sources.

Moreover, higher oil prices will unavoidably exacerbate the inflation problem that central banks around the world are trying to solve, and they will affect the decision to raise interest rates even further to slow down the economy. That might increase the price of gasoline globally and intensify an energy crisis in Europe and the rest of the world that is mostly related to Russian reductions in natural gas supplies used for heating, electricity, and manufacturing.

In the end, it is a reality for the developing and underdeveloped nations, that they will suffer the most. Reserve shortage, high inflation, high food price, and a prolonged energy crisis are what they might expect from the situation.